The Detailed Approach to Smart Debt Monitoring and Long-Term Financial Flexibility

The journey to economic freedom typically starts with a clear understanding of one's debt landscape and the effect it has on general financial health. By diving into strategies that incorporate smart debt management practices and prudent financial planning, individuals can lead a course in the direction of not simply financial debt liberty yet also sustainable financial wellness.

Understanding Financial Debt and Financial Health

To understand the elaborate partnership in between financial debt and financial wellness, one should initially dig into the essential principles of loaning and its effect on overall financial stability. Financial debt, in its significance, is a financial tool that permits individuals and entities to leverage sources past their present means.

Monetary health, on the other hand, includes the capability to take care of financial debt properly while preserving a balanced spending plan and savings plan. Comprehending the sorts of debt, such as rotating credit history, installment car loans, or mortgages, is essential in making educated borrowing decisions. Keeping track of debt-to-income ratios, credit rating, and rates of interest further contributes to an individual's general monetary health.

Setting Clear Financial Goals

Establishing clear economic goals is an important step in the direction of achieving long-lasting monetary stability and success. Establishing certain, measurable, possible, relevant, and time-bound (SMART) goals provides a roadmap for your monetary journey. Begin by evaluating your existing monetary situation, consisting of revenue, expenditures, debts, and cost savings. Determine areas for renovation and identify what you want to accomplish monetarily in the brief, medium, and long term. Whether your goals involve conserving for retirement, getting a home, beginning a service, or paying off financial debt, clearly defining them will aid you stay focused and motivated.

Furthermore, prioritizing your goals based upon their significance and necessity is important. Think about breaking down bigger goals into smaller milestones to make them a lot more workable and track progression in the process. Routinely review and change your economic goals as needed to reflect changes in your circumstances or top priorities. By establishing clear financial objectives and continually functioning towards them, you can lead the way for find more information a more safe and flourishing economic future.

Structure and Executing a Budget Plan

When embarking on the course to financial stability, one essential action is developing and carrying out a detailed budget strategy. Assign a portion of your income to financial savings and focus on financial obligation repayments. By vigilantly following a budget plan, you can take control of your funds, reduce financial obligation, and job in the direction of attaining lasting economic flexibility.

Focusing On Debt Repayment Techniques

Having established a solid budget plan structure, the next important step in achieving economic security is purposefully focusing on financial debt payment methods. Prioritizing financial debt payment includes determining and focusing on high-interest financial debts initially, such as charge card equilibriums or cash advance car loans, to reduce the general passion paid with time. By tackling high-interest financial debts early, people can minimize the monetary worry and liberate extra funds for other economic goals.

An additional reliable approach is the financial debt snowball technique, where debts are paid off in order from tiniest to largest equilibrium. On the various other hand, the financial obligation avalanche technique involves focusing on financial look at this web-site obligations with the highest interest rates no matter of the equilibrium size. hmrc debt collection number.

Buying Long-Term Financial Stability

To protect long-lasting economic stability, prudent investment methods tailored to individual financial goals are necessary. Spending in long-term financial stability includes a calculated approach that thinks about aspects such as threat resistance, time horizon, and monetary goals.

Frequently reviewing and readjusting financial investment profiles as financial objectives develop is likewise vital to maintaining a resilient economic technique. By focusing on long-term economic stability with thoughtful investments, people can work in the direction of accomplishing long-term economic safety and security and freedom.

Final Thought

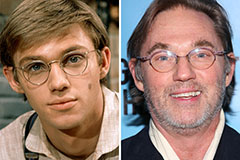

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!